2025 Budget Insights: Stocks to Watch for a Thriving Future

Source: shutterstock

In the Union Budget for 2025, Finance Minister Nirmala Sitharaman laid out a series of bold and forward-thinking initiatives aimed at driving sustainable growth across multiple sectors. These include the launch of the National Mission on High Yielding Seeds, a major push towards clean tech manufacturing, and a new Fund of Funds for startups. Furthermore, significant changes were made in policy areas such as affordable housing, nuclear energy, and foreign direct investment (FDI) in the insurance sector.

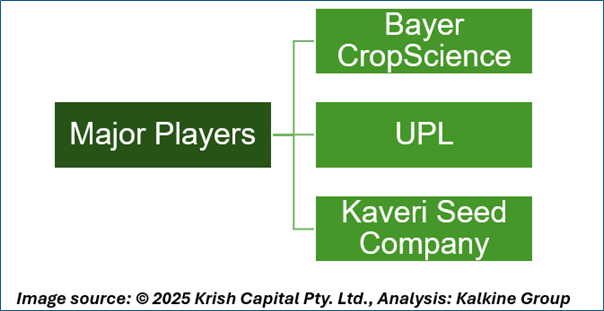

National Mission on High Yielding Seeds

A new National Mission on High Yielding Seeds is set to take off, focusing on transforming the agricultural landscape. This initiative aims to strengthen the research ecosystem and enhance the availability of seeds that are not only high yielding but also resistant to pests and more resilient to climate change. The mission’s success will be rooted in a multi-pronged approach, including targeted development, research, and the propagation of over 100 seed varieties that have been released since July 2024. The goal is to significantly boost agricultural productivity and ensure food security for a growing population

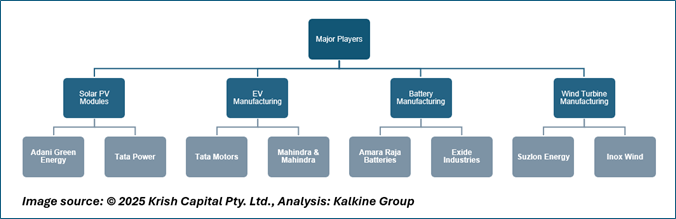

Supporting Clean Tech Manufacturing: The National Manufacturing Mission

The finance minister also unveiled the National Manufacturing Mission, which is designed to bolster India’s capabilities in clean tech manufacturing. This mission targets sectors like solar photovoltaic (PV) modules, electric vehicle (EV) batteries, wind turbines, high-voltage transmission equipment, and grid-scale batteries. As China currently dominates the global clean tech supply chain, this mission seeks to reduce dependence on external sources and empower domestic manufacturers to scale operations and engage in backward integration. Additionally, it complements existing initiatives such as the Production Linked Incentive (PLI) schemes aimed at enhancing the country’s solar and battery manufacturing capacity.

This national push is particularly crucial as the world shifts towards greener energy solutions. By focusing on these industries, India is positioning itself as a key player in the global clean energy movement, while also addressing the domestic demand for sustainable infrastructure.

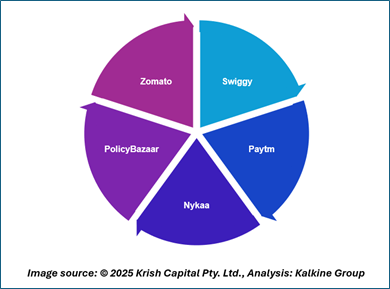

Empowering Startups: A New Fund of Funds

The government has recognized the crucial role that startups play in driving innovation and creating jobs. To further boost entrepreneurship, a new Fund of Funds for Startups will be established with an additional contribution of Rs. 10,000 crores, bringing the total fund to Rs. 20,000 crores aimed at boosting entrepreneurship and innovation. This initiative will provide vital financial support to early-stage startups, helping them scale and introduce new solutions to the market. The fund is expected to strengthen the venture capital ecosystem, particularly benefiting high-growth sectors such as fintech, healthtech, edtech, and agritech.

India's burgeoning tech startup ecosystem may see increased investor interest. Furthermore, venture capital-backed companies across various sectors could benefit from the growing flow of capital.

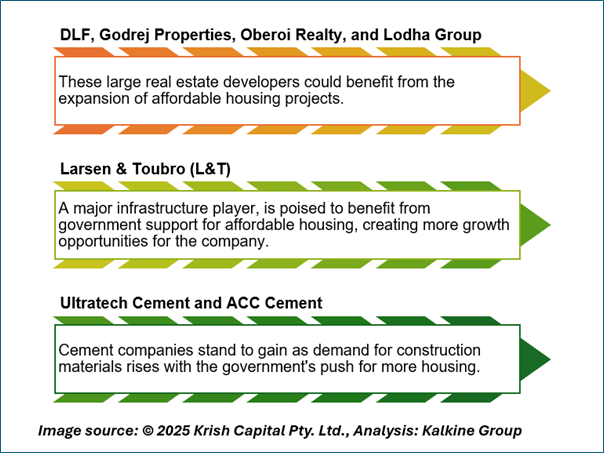

Affordable Housing: Expanding the Vision

Affordable housing continues to be a priority for the government, with plans to complete an additional 40,000 housing units by FY26, signaling a growth opportunity for the real estate and construction sectors. This initiative aligns with India’s vision of providing affordable and decent living conditions for its population. It also supports the broader goal of inclusive growth, with affordable housing playing a crucial role in the country’s social and economic development.

Key stocks to watch in this space

Powering India’s Future: Nuclear Energy Growth

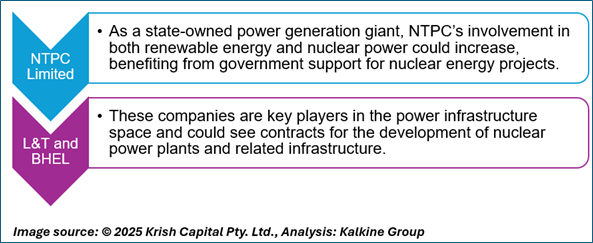

The finance minister also emphasized the importance of nuclear energy in India's long-term energy strategy. By 2047, the government aims to achieve a total nuclear energy generation capacity of 100 gigawatts. To facilitate this, amendments to the Atomic Energy Act and Civil Liability for Nuclear Damage Act will be made, aiming to encourage greater private sector participation. This move signals India’s commitment to diversifying its energy mix and ensuring that nuclear power plays a significant role in the country’s energy transition. Stocks in the power generation sector, particularly those involved in nuclear power, could see long-term growth.

Insurance Sector: Boosting FDI Inflow

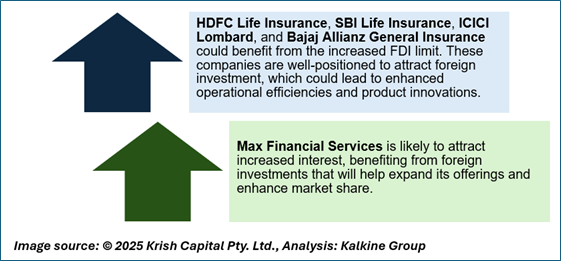

In a significant policy shift, the government has announced the raising of the foreign direct investment (FDI) limit in the insurance sector from 74% to 100%. This will open up greater opportunities for foreign investment and bring in expertise to further develop the sector. By allowing firms that invest their entire premium in India to hold 100% ownership, the government is enhancing the competitiveness of India’s insurance market, encouraging innovation and improving access to insurance products for the masses.

Conclusion

The Union Budget for 2025 outlines a series of strategic initiatives designed to foster sustainable growth, encourage innovation, and enhance the resilience of India’s economy. From agriculture to clean tech, startups to housing, and nuclear energy to insurance, these initiatives mark a bold step towards achieving long-term, inclusive development. By addressing both current needs and future challenges, India is positioning itself to be a global leader in multiple key sectors, driving economic progress while ensuring sustainability for generations to come.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.