Union Budget 2025 Preview - Infrastructure, Clean Energy, and Tech Could Shape India’s Economy

Source: shutterstock

As India faces a multi-quarter low in GDP growth reported 5.4% in Q2FY25 vs 8.1% in Q2FY24, all eyes are on Finance Minister Nirmala Sitharaman’s Union Budget 2025, set to be presented on February 1, 2025. With economic momentum slowing, the government is expected to use this crucial budget to provide a much-needed boost to consumption, infrastructure, and innovation. Let’s take a closer look at what sectors are likely to benefit from the anticipated budget announcements and which major players stand to gain.

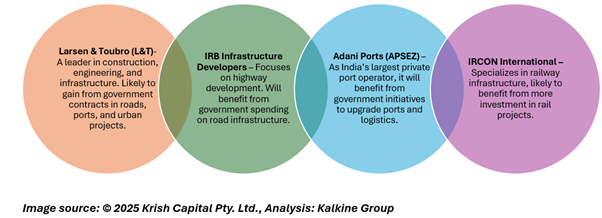

Infrastructure Development: Stimulating Growth and Employment

Infrastructure remains the backbone of India’s economic development, and the Union Budget 2025 is expected to ramp up investments in this sector. Infrastructure-focused initiatives spanning roads, railways, ports, and digital connectivity are likely to feature prominently. The government is also expected to make a push for more capital expenditure, aimed at creating long-term economic growth and employment opportunities.

Key Stocks to Watch

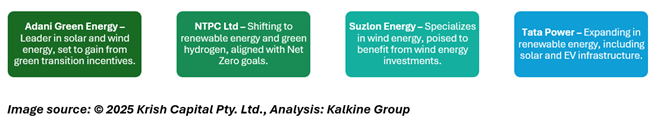

Green Transition: Investing in Clean Energy and Sustainability

The focus on clean energy and sustainability is expected to intensify in the upcoming budget. With India committed to achieving Net Zero emissions by 2070, the government is likely to unveil incentives for renewable energy projects, such as solar parks, hydrogen hubs, and energy efficiency measures.

Key Stocks to Watch

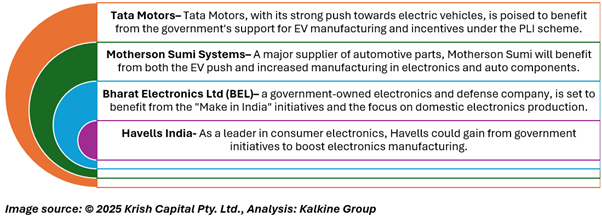

Revitalizing Domestic Manufacturing: Strengthening ‘Make in India’

To revive domestic manufacturing and reduce import dependency, the government is expected to focus on extended production-linked incentives (PLIs) for key sectors like electronics, electric vehicles (EVs), and semiconductors. Streamlined regulations and support for emerging industries will further strengthen India’s supply chains and attract global investments.

Key Stocks to Watch

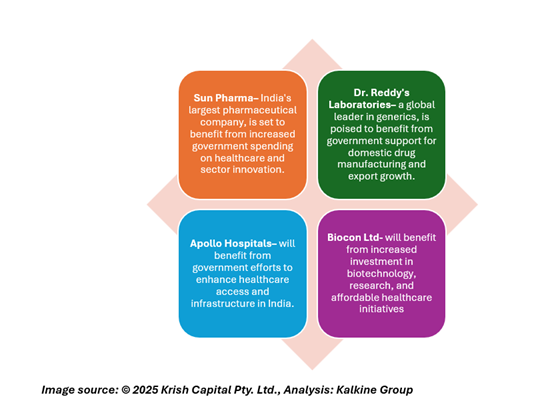

Pharmaceutical and Healthcare Industry: Boosting Innovation and Infrastructure

The Indian pharmaceutical sector is also looking to the Union Budget 2025 for increased government support in strengthening infrastructure and driving innovation. With India being a global leader in generic medicines, the budget could focus on enhancing R&D capabilities and bolstering healthcare infrastructure to cater to the growing demand for healthcare services.

Key Stocks to Watch

Tech and Digital Transformation: Empowering Industries through Innovation

As India moves forward on its digital transformation journey, the government is expected to place a strong emphasis on enhancing digital infrastructure. With a focus on technologies such as artificial intelligence (AI), edge computing, and cloud solutions, the budget is expected to incentivize the adoption of transformative technologies that will boost scalability, security, and innovation across industries.

Key Stock Players to Watch

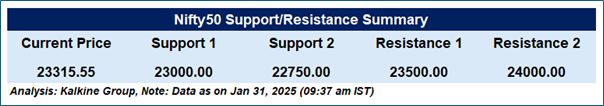

Nifty 50 Technical Analysis

The NIFTY 50 index is currently in a bearish phase, trading below both the 21-day and 50-day Exponential Moving Averages (EMAs), signaling weakness in the short to medium term. Nifty50 current trading at 23,315.55 (31 January 2025, 9:37 AM IST) it faces immediate resistance around 23,500 and a stronger resistance at 24,000, which previously acted as a supply zone. On the downside, 23,000 is a critical support level, and if breached, further declines towards 22,750 and 22,500 could follow. The Relative Strength Index (RSI) at 47.64 indicates neutral momentum, suggesting that the market is neither overbought nor oversold, which leaves room for both consolidation or breakout opportunities.

With the Union Budget approaching, investors are hopeful for announcements that could shift market sentiment. Although the short-term outlook remains bearish, strong measures like infrastructure spending or tax reforms could help push the NIFTY 50 past key resistance levels (23,700-24,000), signaling a potential uptrend.

The index has been in a correction since its September-October 2024 peak, within a broader bullish cycle. Positive budget policies could end this correction and spark bullish momentum. However, failure to hold support at 23,000 could lead to further declines towards 22,500. Investors should monitor key levels and volume closely in the lead-up to the budget.

Conclusion

As India anticipates the Union Budget 2025, key sectors like infrastructure, clean energy, domestic manufacturing, pharmaceuticals, and digital transformation are expected to benefit from targeted government initiatives. While the NIFTY 50 index is currently in a bearish phase, strong budgetary measures could reverse market sentiment, driving the index past critical resistance levels and potentially signaling an uptrend. However, investors should remain cautious, closely monitoring key support levels and market volume for any signs of a shift in momentum.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.