Hindenburg Research Disbands - A New Era for Adani Group Stocks

Source: shutterstock

The Adani Group saw a significant rebound in its stock prices on January 16, 2025, following the announcement of Hindenburg Research’s disbandment. Shares of key group companies, including Adani Power, Adani Green Energy, and Adani Enterprises, surged by up to 9%, marking a sharp reversal from the market volatility triggered by Hindenburg's January 2023 report. The rally extended to other Adani companies such as NDTV, Adani Ports, and Ambuja Cements, reflecting renewed investor confidence.

In early 2023, Hindenburg Research accused the Adani Group of stock manipulation, accounting fraud, and corporate malpractices, leading to a sharp drop in stock prices and regulatory investigations. These allegations put a shadow over Adani's expansion across sectors like energy, infrastructure, and logistics.

However, in a surprising twist, Hindenburg Research announced it would cease operations on January 16, 2025. While the reasons behind this decision remain unclear, some suggest it could be tied to the firm's controversial reports and legal challenges. Founder Nate Anderson confirmed that the firm had planned to wind down after completing its pipeline of projects.

The announcement of Hindenburg Research’s closure sparked a rally in Adani Group stocks, signaling a shift in market sentiment and restoring investor confidence in the conglomerate following months of intense scrutiny.

Stock Technical Analysis

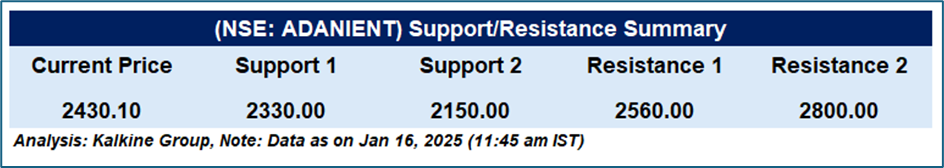

Adani Enterprises Ltd (NSE: ADANIENT) was trading at the current price of ₹2430.10 (as of 16 January 2025, 11:45 am IST), showing a bearish to neutral trend, trading below the 50-day EMA of ₹2548.71. The stock recently tested support at ₹2200, with ₹2400 serving as short-term support. The next key support is ₹2330, and a break below this could lead to further downside, potentially testing ₹2150. On the upside, ₹2560 is immediate resistance, followed by ₹2800. The RSI at 47.6 indicates neutral momentum, with a move above 50 signalling bullish potential. A breakout above ₹2560 could signal a trend reversal, while a drop below ₹2150 may result in further downside.

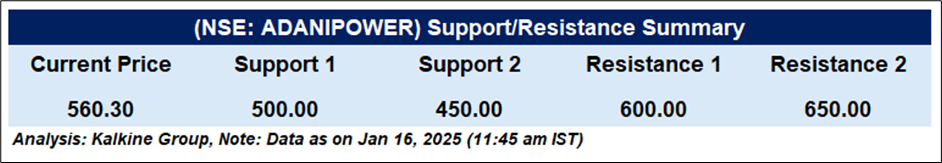

Adani Power Ltd (NSE: ADANIPOWER) was trading at the current price of ₹560.30 (as of 16 January 2025, 11:45 am IST), has recently broken above its 50-day EMA (₹535.56), signaling a potential shift to a bullish trend, with strong buying momentum reflected in recent price movements. Immediate support levels are at ₹535 (50-day EMA), ₹500 (psychological support), and ₹450 (tested in November-December). On the upside, resistance is found around ₹570–₹580, with critical levels at ₹600 and ₹650. The RSI stands at 59.3, indicating strengthening bullish momentum without being overbought yet. A sustained breakout above ₹580 could target ₹600 and beyond, while a drop below ₹535 could revisit lower support levels. Caution is advised as the stock approaches overbought conditions near ₹600.

Conclusion

The disbandment of Hindenburg Research on January 16, 2025, triggered a strong rebound in Adani Group stocks, with key companies like Adani Power, Adani Green Energy, and Adani Enterprises seeing significant gains. This shift reflects restored investor confidence. While technical indicators suggest potential for further upside, caution is advised as stocks approach resistance levels and overbought conditions. Monitoring key support and resistance points will be crucial in determining the sustainability of the rally.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.