Adani Ports Achieves Environmental Leadership but Faces Technical Setbacks in Stock Performance

Source: shutterstock

Adani Ports and Special Economic Zone Ltd. (APSEZ) has secured a prestigious spot among the Top 10 global companies in the transportation and transportation infrastructure sector, according to the 2024 S&P Global Corporate Sustainability Assessment (CSA). This recognition highlights APSEZ's commitment to sustainable practices and operational excellence, earning the company an impressive score of 68 out of 100—a three-point improvement from last year. With this achievement, APSEZ now ranks in the 97th percentile within its sector, advancing from the 96th percentile in 2023.

Environmental Leadership and Excellence

For the second consecutive year, APSEZ has been ranked #1 in the Environment dimension of the CSA. This accolade reflects the company's trailblazing initiatives in sustainability, setting a benchmark for the industry. Beyond environmental leadership, APSEZ has excelled in several critical areas within the Social, Governance, and Economic dimensions. The company achieved top scores in Transparency and Reporting, Materiality, Supply Chain Management, Information Security/Cybersecurity & System Availability, and Customer Relations. These distinctions underscore APSEZ's comprehensive approach to sustainability and its unwavering focus on governance.

A Vision for the Future

This recognition not only highlights APSEZ's accomplishments but also emphasizes its vision for the future. By embedding sustainability into its core operations, APSEZ continues to strengthen its reputation as a global leader in sustainable practices. The company remains focused on driving innovation, maintaining transparency, and creating long-term value for all its stakeholders. With its ambitious Net Zero by 2040 goal, APSEZ sets a high standard for others in the industry to follow.

Technical Summary

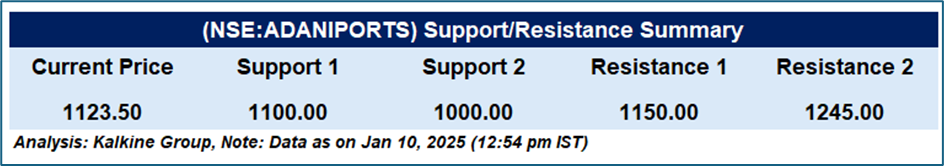

Adani Ports and Special Economic Zone Ltd (NSE: ADANIPORTS) was currently trading at ₹1123.50 (as of 10 January 2025, 12:54 pm IST), is showing bearish momentum, trading below the 50-period EMA of ₹1244.69. The stock is in a downtrend, and with the RSI at 34.05, it is nearing oversold conditions, which may trigger a short-term bounce. Immediate support is at ₹1100, and a break below this level could lead to further downside, potentially testing ₹1000, a key psychological level. On the upside, resistance is at ₹1150, which has previously acted as a rejection point; if the stock rallies towards this level and faces rejection again, it could present a good shorting opportunity. The next significant resistance is at ₹1245, aligning with the 50-period EMA, but unless the stock shows a clear reversal, the broader trend remains bearish. Traders should focus on the ₹1100 and ₹1150 levels for potential short entries, monitoring price action carefully to capitalize on any movement in the downtrend.

Adani Ports has reported an 8% growth in its total cargo volume, reaching 38.4 million metric tons (MMT) in December 2024. This increase is largely driven by a 22% rise in container volumes and a 7% increase in liquids and gas volumes. Overall, Adani Ports handled a total of 332.4 MMT of cargo, showcasing strong performance in key segments of its operations. The growth in container and liquids/gas volumes suggests that the company continues to see demand in these critical areas, which could support its revenue and profitability moving forward. This positive development in cargo handling could potentially provide a buffer against the current bearish technical setup of the stock. However, traders should still closely monitor price action around the key support and resistance levels for any potential moves in the stock.

Conclusion

Adani Ports has demonstrated solid operational performance with strong cargo volume growth, yet its stock is facing bearish technical signals. While its sustainability achievements and sector leadership contribute to long-term value, the stock remains under pressure below key resistance levels. Traders should closely monitor support at ₹1100 and resistance at ₹1150 to assess potential shorting opportunities or a reversal in trend. Caution is advised as the near-term price action remains uncertain.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.