HCL Technologies Reports Q3 FY25 Earnings – Revenue Grew 5.1% YoY

Source: shutterstock

HCL Technologies, one of India's top IT firms, released its financial results for Q3 FY25 on January 13, 2025, showing steady revenue and profit growth. Despite the positive results, the company's stock, which had been trading near an all-time high before the announcement, saw a 9% decline on January 14, 2025, following the release. This drop raised concerns among investors, despite the company’s solid performance during the quarter.

Key Financial Highlights

- Revenue Growth

- Revenue increased by 5.1% YoY to ₹29,890 crore in Q3 FY25, up from ₹28,446 crore in Q3 FY24.

- On a constant currency (CC) basis, the revenue grew 4.1% YoY.

- EBIT Performance

- Earnings Before Interest and Tax (EBIT) rose 3.7% YoY to ₹5,821 crore in Q3 FY25, compared to ₹5,615 crore in Q3 FY24.

- Net Income

- Net income increased 5.5% YoY, reaching ₹4,591 crore in Q3 FY25, up from ₹4,350 crore in Q3 FY24.

- HCL Software ARR

- Annual Recurring Revenue (ARR) for HCL Software declined by 0.6% YoY on a CC basis, standing at USD 1.02 billion in Q3 FY25 compared to USD 1.05 billion in Q3 FY24.

- Updated Guidance

- HCL Technologies narrowed its FY25 revenue growth guidance for the overall business and services segment on a constant currency basis. The company now expects growth between 4.5%-5%, compared to the previous range of 3.5%-5%. However, it maintained its EBIT margin guidance of 18-19%, signaling confidence in operational efficiency.

- Dividend Announcement

- HCL Technologies declared an interim dividend of ₹12 per share and a special dividend of ₹6 per share, underscoring its commitment to shareholder returns.

- Deal Wins

- The company reported a robust Total Contract Value (TCV) of new deal wins amounting to USD 2,095 million in Q3 FY25, reflecting its ability to secure large-scale contracts despite market headwinds.

Market Reaction

Despite the positive financial performance, HCL Tech’s stock fell by 9% following the earnings announcement. Analysts attributed the decline to concerns over the subdued growth in the HCL Software segment, the narrower revenue guidance, and heightened market expectations that were not fully met.

Stock Technical Analysis

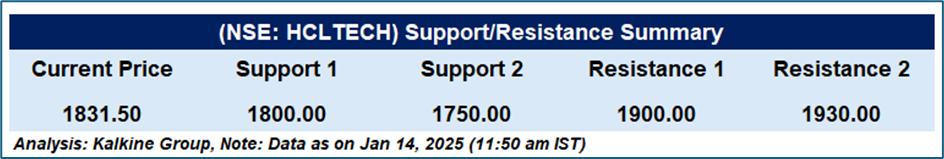

HCL Technologies Ltd (NSE: HCLTECH) was trading at the current price of ₹1831.50 (as of 14 January 2025, 11:50 am IST), reflecting a sharp decline of 7.94%. This move signals a bearish shift, with the stock recently breaking below the 50-day Exponential Moving Average (EMA), suggesting potential further downside momentum. The Relative Strength Index (RSI) is at 38.38, approaching oversold territory, but it hasn't yet reached a level that signals an imminent reversal. Immediate resistance is identified around ₹1900–₹1930, while key support levels are at ₹1800 and ₹1750. Traders should be alert for a reversal pattern near support or a move above ₹1900 for a potential bullish entry. Investors might consider accumulating shares at the support levels, provided the company’s fundamentals remain strong. However, if the stock continues to trade below ₹1800, it could indicate further downside risk.

Conclusion

HCL Technologies delivered a mixed performance in Q3 FY25, balancing steady growth in its core businesses with challenges in its software vertical. The narrowed revenue guidance, combined with investor concerns, has led to short-term pressure on the stock. However, the company’s robust deal pipeline and commitment to shareholder returns position it well for sustained performance in the long term.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.