Indian IT Stocks Thrive on Global Digital Transformation and Fed Rate Cut Buzz

Source: shutterstock

Key Highlights

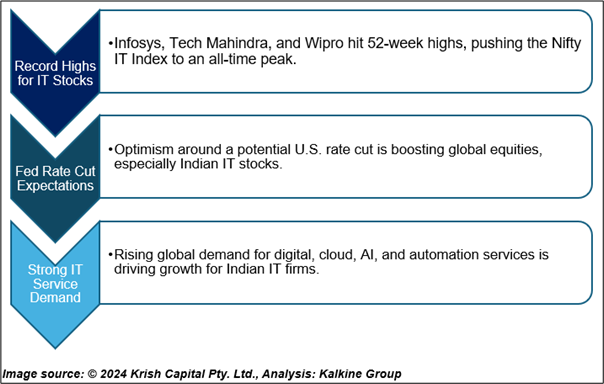

On December 12, 2024, shares of leading Indian IT companies, such as Infosys, LTI Mindtree, Tech Mahindra, and Wipro, hit their 52-week highs, driving the Nifty IT Index to a new all-time peak. This surge in stock prices comes amidst growing investor optimism, particularly centered around the anticipation of a possible interest rate cut by the Federal Reserve (Fed) in the United States. Here's a closer look at the key factors propelling this rally and what it means for the future of Indian IT stocks.

Key Drivers of the IT Sector Surge

- Expectations of a Fed Rate Cut: The U.S. inflation rate showed a modest increase of 2.7% year-over-year in November, raising hopes that the Federal Reserve might ease its monetary policy. This has fueled expectations of an interest rate cut, as signs of a slowdown in the U.S. economy and moderating inflation could prompt the Fed to reduce rates. Lower interest rates would make borrowing cheaper globally, particularly benefiting sectors like IT that rely heavily on global capital markets for expansion and innovation. As a result, global equities—especially those in high-growth industries—are poised to benefit from this shift in monetary policy.

- Sustained Global Demand for IT Services: The demand for IT services worldwide continues to grow, driven by increased outsourcing, the expansion of digital platforms, and rising investments in technologies such as artificial intelligence (AI), cloud computing, and automation. Indian IT giants like Infosys, Wipro, and Tech Mahindra are strategically positioned to tap into these trends, as they are leaders in providing cutting-edge digital transformation services. This robust demand provides a strong revenue pipeline for these companies, boosting investor confidence.

- Favorable Macroeconomic Conditions: India’s economy remains strong, providing a supportive environment for its technology-driven industries. The Indian government’s initiatives to promote digitalization and innovation, coupled with the global adoption of advanced technologies, have positioned India as a hub for IT outsourcing and tech services. Additionally, India's improving domestic market conditions and strong business sentiment contribute to the positive outlook for the IT sector.

Record Highs for Major IT Stocks

On December 12, 2024, the Nifty IT Index rose by 0.77%, achieving a new record high of ₹46,002. The performance of major IT companies has been central to this achievement:

- Infosys (INFY): Infosys' shares surged to a 52-week high of ₹1,998.80, bolstered by its strong performance in digital services and successful forays into high-growth markets like AI and cloud computing. The company's ability to adapt and innovate has helped it maintain a competitive edge in the global market. The share price was traded at ₹1,987.00 (at the closing of 12 December 2024)

Source: Refinitiv, Analysis by Kalkine Group

- Tech Mahindra (TECHM): Tech Mahindra also saw its stock climb to ₹1,807.70, reaching a 52-week high. The company’s investments in next-generation technologies such as 5G, automation, and AI have strengthened its market position, garnering investor optimism for long-term growth. The share price was traded at ₹1,789.60 (at the closing of 12 December 2024).

Source: Refinitiv, Analysis by Kalkine Group

- Wipro (WIPRO): Wipro’s stock reached ₹313.80, its highest point in a year, reflecting investor confidence in its ongoing expansion in digital services and automation. The company’s focus on transforming its business model to meet evolving global tech needs has resonated positively with the market. The share price was traded at ₹309.10 (at the closing of 12 December 2024).

Source: Refinitiv, Analysis by Kalkine Group

Index Technical Analysis

The NIFTY IT index has been in a strong uptrend over the past 6 months, forming higher highs and higher lows, reflecting sustained bullish momentum. However, after a significant upward move, the index is currently experiencing a minor correction, which is typical after such rallies. The RSI, at 71.89, shows positive momentum but is nearing the overbought zone. The slight downward slope of the RSI signals a potential short-term cooling off. Key levels to watch include support at 44,500, where sustaining above this level may help resume the uptrend. Resistance at 46,500 is another crucial level, as selling pressure could emerge here. Overall, the trend remains bullish, and traders should monitor both the RSI and price action closely for any signs of a potential reversal. The index price was traded at ₹45,701.65 (at the closing of 12 December 2024).

Source: Refinitiv, Analysis by Kalkine Group

Positive Outlook for the Sector

The rally in the Nifty IT index reflects broader investor confidence in the Indian IT sector, supported by favorable global and domestic conditions. If the Fed follows through on rate cuts, it could further enhance the growth potential of the technology sector. Lower rates would reduce capital costs and fuel investment in technology, providing a continued boost to Indian IT companies.

Moreover, Indian IT firms like Infosys, Wipro, and Tech Mahindra continue to be well-positioned to capitalize on the global digital transformation wave. With increasing adoption of AI, cloud computing, and automation across industries, these companies are expected to maintain strong growth, making them attractive investment opportunities.

Conclusion

The surge in the Nifty IT index and the impressive stock performances of Infosys, Tech Mahindra, and Wipro highlight the strong fundamentals of the Indian IT sector. As the global tech demand remains robust and expectations of a Fed rate cut grow, Indian IT companies are poised for further expansion. Investors are closely watching these developments, as the sector offers promising growth prospects in the coming months.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.